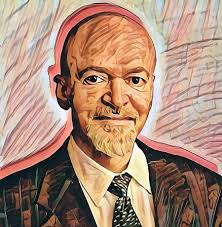

What if mathematical knowledge is applied in the world of trading? William Eckhardt explains that mathematical concepts can be applied in trading, even though trading itself is full of uncertainties. However, by using probability analysis and statistics, these concepts can generate successful strategies. Eckhardt, a prominent commodities and futures trader as well as a fund manager, has proven the success of these concepts. Nevertheless, he also warns that such analysis can lead to pitfalls if done without a deep understanding of the market and statistics.

Eckhardt, a mathematician fascinated by the world of trading, chose to utilize these concepts despite being aware of the risks. A graduate of the doctoral program at the University of Chicago in mathematical logic, Eckhardt opted out of the program when he became interested in trading. Nonetheless, he continued to study mathematics and published several scholarly articles. One of his articles, "Probability Theory and the Doomsday Argument," was published in the philosophy journal Mind in 1993.

In addition to basing his strategies on mathematical concepts, Eckhardt also has two tips that helped him achieve success:

Career journey stories and perspectives like these can provide valuable insights for traders and investors. The mathematical approach in trading, while considering its risks, as well as consistency in improving trading strategies are the keys to success according to William Eckhardt.