From a technical perspective, I see that Gold has reached a price level worth considering for potential entry points.

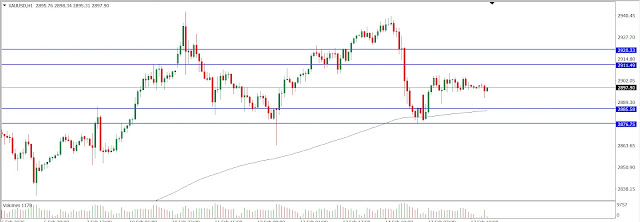

Let’s take a look at the 1-hour timeframe chart before analyzing further:

Price Action Analysis (Trader Pressure)

In the current market trend, Gold remains in a Bullish/Uptrend condition. However, we must also anticipate a potential trend reversal if the price breaks below the support area, as well as possible price consolidation.

From the candlestick history, we can identify buying opportunities, but to remain objective, I will present an analysis for both buy and sell entries.

Looking at the chart, Buyer pressure (long green candles) has gradually pushed the price higher without significant resistance from Sellers (short red candles), forming a Higher Low.

This indicates that Buyers are still dominating the price action at key levels. However, there are still opportunities for Sell entries in this Gold market.

- Resistance Area: 2920.33 – 2911.49

- Support Area: 2885.58 – 2876.75

Entry Setup Options

Breakout Opportunity Setup

- Buy Entry: If the 1-hour candle closes above the upper resistance boundary (2920.33), look for the best buy entry.

- Sell Entry: If the 1-hour candle closes below the lower support boundary (2876.75), prepare for a sell entry.

- Cut Loss:

- For Buy Entry, set a stop loss if the 1-hour candle closes below 2911.49.

- For Sell Entry, set a stop loss if the 1-hour candle closes above 2885.58.

- Risk-Reward Ratio: Maintain a minimum 1:1 risk-reward ratio.

Pullback Setup for Sell Entry

- Pullback Area: Resistance zone (2920.33 – 2911.49).

- If the 1-hour candle closes within the pullback area, a Sell position can be considered.

- Stop Loss: If the 1-hour candle closes above 2920.33, exit the sell position.

- Risk-Reward Ratio: Minimum 1:1, adjust to your trading strategy.

Pullback Setup for Buy Entry

- Pullback Area: Support zone (2885.58 – 2876.75).

- If the 1-hour candle closes within the pullback area, a Buy position can be considered.

- Stop Loss: If the 1-hour candle closes below 2876.75, exit the buy position.

- Risk-Reward Ratio: Minimum 1:1, adjust to your trading strategy.

Always implement proper money management for sustainable trading and be cautious of Fake Breakouts.

I hope this analysis serves as a useful reference for your market trading decisions.

Happy Trading! 🚀

.jpg)

.png)

.jpg)

.png)